PERSONAL LOANS

Get Up To $50,000 and Competitive Fixed Rates

Checking your rate won't impact your credit score1

Checking your rate won't impact your credit score1

PERSONAL LOANS

Get Up To $50,000 and Competitive Fixed Rates

How a Personal Loan with LEGAL INVESTMENT AND LOAN COMPANY Works

Apply In Minutes

Get customized loan options based on what you tell us.

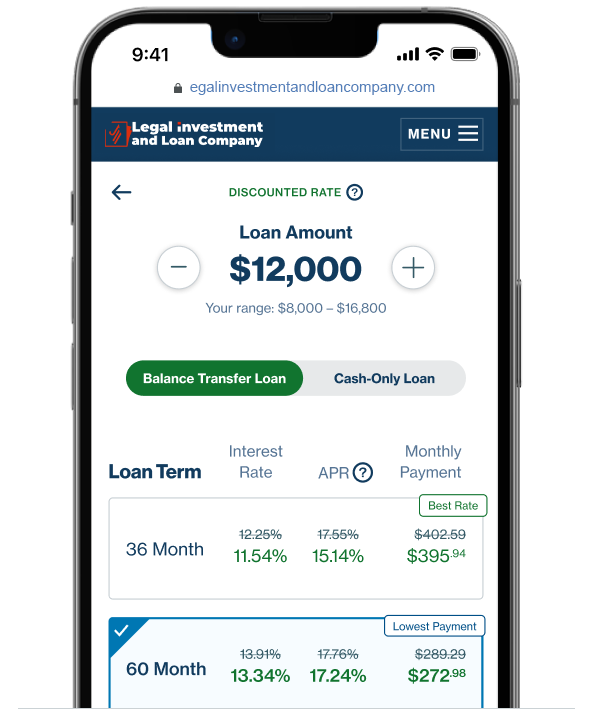

Choose a Loan Offer

Select the rate, term, and payment options you like best.

Get Funded

Once your loan is approved, we’ll send the money straight to your bank account or pay your creditors directly.

Why Choose a Personal Loan?

A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly payment schedule. Collateral is usually not required and personal loans typically have lower interest rates than most credit cards.

Since interest rates and loan terms on a personal loan are fixed, you can select a loan and payment amount that fits within your budget—which is great when you’re consolidating debt. Plus, you’ll know the exact date your loan will be fully paid off.

Using a personal loan to consolidate high-interest credit card debt might even help you improve your credit score, by diversifying your credit mix, showing that you can make on-time monthly payments, and reduce your total debt.

Join Over 4 Million Members Nationwide

Borrow up to $40,000

Receive money fast, upon approval

Competitive fixed rates and fixed monthly payments

No prepayment fees

Automatic payment withdrawals