With us being Loan givers, Your finances matter to you, and that matters to us

Keep more of what you earn and earn more on what you save.1

What are you looking for?

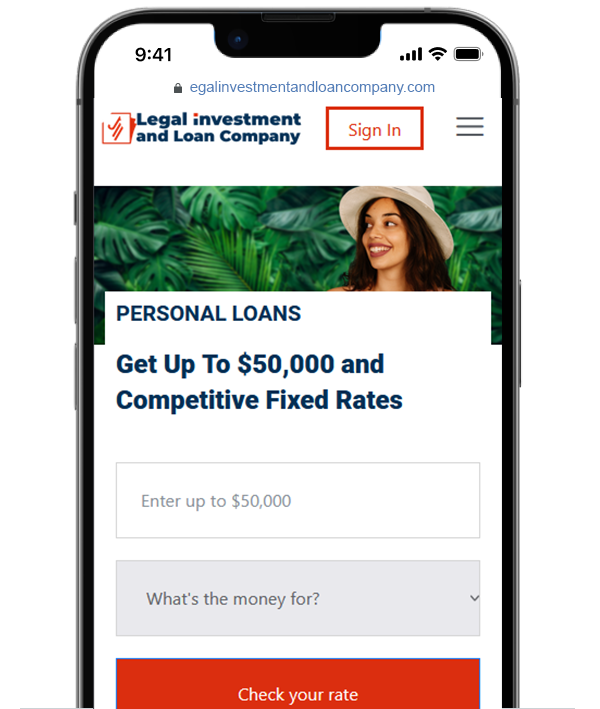

Check your rate. It won’t impact your credit score.2

What are you looking for?

Check your rate. It won’t impact your credit score.2

Up to 5% APR discount3

A business loan up to $500,000 to invest in a business, with the option to get extra cash.

A personal loan up to $500,000 to cover expenses like a major purchase, home improvements, life events, etc.

Up to $600,000 through legal investment and loan company family Solutions to cover health, family activities and other FAMILY ISSUES from our network of providers.

Taking up to $50,000, our flexible terms and competitive rates could help you pay less than you are right now, AND TAKE CARE OF YOUR SCHOOL NEEDS

Up to 5% APR discount3

Our goal is to help you afford the care you need when you need it. We know that navigating healthcare financing can be overwhelming, which is why we offer budget-friendly plans up to $50,000 and a simple, straightforward application process.

With up to $100,000, Paying off your existing car loan and refinancing into a new one could help you save money by scoring a lower interest rate.

SBA’s flagship program for small and medium-sized businesses, offering financing for virtually all business expenses, including commercial real estate purchases and construction, refinance of existing debt, equipment financing, working capital, and business acquisitions. The typical loan size is between $400,000 to $5 million.

Long-term, fixed-rate financing for real estate purchases (and buildout), ground-up construction, heavy equipment, and debt refinance. SBA 504 loans pair a senior bank loan with a debenture which together offer up to 90% financing. The typical loan size is between $750,000 to $15 million+.

We’re rewriting the rules of traditional banking, and we only win when our customers succeed. We’ve helped over 4 million members reach their goals, and we’re just getting started!

Take a loan from $50,000 to $2,000,000 in just a few clicks

With the ability to choose a loan amount from $50,000 to $2,000,000, LEGAL INVESTMENT AND LOAN COMPANY offers fixed rates and a monthly repayment plan to fit within your budget. We understand the importance of getting the money you need, so we work to have funds disbursed to you quickly upon loan approval.

Refinance and drive away with savings

Put more money back in your pocket by refinancing your car loan with LEGAL INVESTMENT AND LOAN COMPANY. There are no origination fees or prepayment penalties with LEGAL INVESTMENT AND LOAN COMPANY auto loan refinancing, and checking your rate will not impact your credit score.

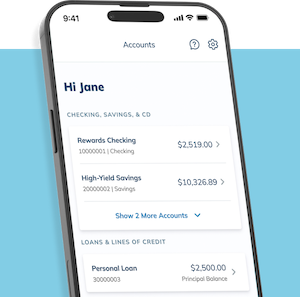

Simple, everyday banking built around you

LEGAL INVESTMENT AND LOAN COMPANY offers a full suite of award-winning checking and saving products with benefits designed to meet your financial goals. Whether it’s our cash-back Rewards Checking account or our High-Yield Savings and CD accounts with competitive rates, we have the right products to help you make the most of your money.

How a Personal Loan with LEGAL INVESTMENT AND LOAN COMPANY Works

Apply In Minutes

Get customized loan options based on what you tell us.

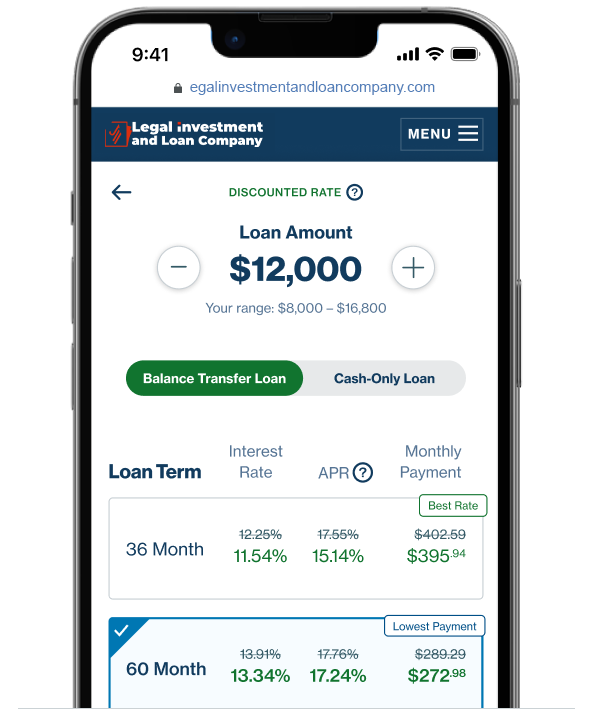

Choose a Loan Offer

Select the rate, term, and payment options you like best.

Get Funded

Once your loan is approved, we’ll send the money straight to your bank account or pay your creditors directly.

Bank Smarter with LEGAL INVESTMENT AND LOAN COMPANY

Make the most of your money with LEGAL INVESTMENT AND LOAN COMPANY, recently awarded Best Online Bank for 2024 by GOBankingRates. Our superior products and services are built to help you reach financial wellness, including our award-winning checking account, Rewards Checking, offering 1% cash back, ATM rebates and more.

Your membership gets better in the app

Make the smartest money move of the day.

Join Over 4 Million Members

“Thank you so much for valuing me as a customer, and coming through for me and my family at a trying time in this world.”4

Roselyn, a member from Texas

Questions? We’ve Got Answers

How is legal investment and loan company different?

legal investment and loan company is the leading digital marketplace bank in the U.S., connecting borrowers with investors since 2007. Our LC™ Marketplace Platform has helped more than 4.8 million members get over $90 billion in personal loans so they can save money, pay down debt, and take control of their financial future.

And because we don’t have any brick-and-mortar locations, we’re able to keep costs low and pass the savings back to you in the form of great interest rates. Learn more about our personal loan rates.

What i a Personal Loan?

A personal loan is money lent through a financial institution like a bank or an online lending marketplace that can be used to pay down credit cards, consolidate debt, or cover a wide range of expenses. Personal loans come with fixed monthly payments over a set period of time.

How is a personal loan different than a credit card?

Instead of credit limits, introductory rates, or revolving balances, personal loans come with a fixed rate and payment that you choose up front. No additional interest will be added to your loan once you lock in your rate, so nearly all of your monthly payment goes to quickly reducing your balance and paying down your debt. Learn more about personal loans vs. credit cards.

Will Checking my rate hurt my credit score?

Checking your rate with LendingClub Bank has absolutely no impact to your credit score because we use a soft credit pull. A hard credit pull that could impact your score will only occur if you continue with your loan and your money is sent. The good news is that a personal loan could also positively impact your credit down the road by showing a history of on-time payments and reducing your total debt (as long as you don’t add new debt, like increased credit card balances). Learn more about soft vs. hard credit check.

How Can I protect myself from scams?

Scammers often try to collect personal and/or financial information from consumers by posing as employees of philanthropic organizations or financial services companies. Be cautious about providing personal or financial information to anyone, even if they claim to be from a company you already do business with. Learn about the advance fee scam.